from REALTORMAG.REALTOR.ORG

March/April 2016 Issue

Nearly 50 years since the federal ban on housing discrimination, upholding the law’s spirit remains a challenge. Here’s how to be a fair housing leader.

By Graham Wood

Sandra Butler refused to let it slide when a seller she represented last year made what felt like a discriminatory comment. The seller thought the buyers, who had foreignsounding names, were trying to negotiate for too many repairs. “I know how these people are, and they always want something for nothing,” Butler recalls the seller saying.

Butler is African-American. So was her client. And she didn’t want the seller to “think this conversation could be had because we look alike,” she says. Instead of flatly admonishing her client, Butler turned the conversation to fair housing law. “I said, ‘I don’t know the buyers or what they look like. I just know they are ready, willing, and able to purchase, and it’s our duty under the law to make your property available to them,’” says Butler, a sales associate with Sibcy Cline, REALTORS®, in Cincinnati. The deal ultimately fell apart over negotiation terms, but Butler was satisfied that she’d made her client more aware of a seller’s responsibility to abide by the federal Fair Housing Act, which prohibits inequitable treatment in the sale, rental, and financing of homes based on race, color, national origin, religion, sex, disability, and the presence of children.

Have you seen discrimination in your market?

9% have.

Source: REALTOR® Magazine survey of 2,300 NAR members

25,000 to 30,000 complaints, annually; 3.7 million estimated instances of discrimination

Source: National Fair Housing Alliance

Each April, REALTORS® celebrate Fair Housing Month to commemorate the law, which was passed in 1968 and amended in 1988. Yet nearly 50 years after its passage, racial and religious tensions continue to dominate national conversations and stoke heated rhetoric in presidential politics. Is that tension having an effect on real estate sales? Apparently not. Housing discrimination is the exception today, according to a survey REALTOR® Magazine conducted with NAR members in February. Of the 2,300 respondents, more than 80 percent said they had not encountered housing discrimination in their market.

That’s great news. And yet, fair housing challenges remain. Violations—and government efforts to enforce the law—continue. Nearly 10 percent of respondents to the survey said they had encountered discrimination in their markets, 18 percent of those saying it happened within the past month or “earlier this year.”

Fair housing organizations receive about 25,000 to 30,000 complaints each year, according to the National Fair Housing Alliance, a coalition of privately run fair housing groups. Yet, testing suggests there are many more instances of discrimination—the NFHA estimates about 3.7 million annually. The U.S. Department of Housing and Urban Development has conducted thousands of tests in recent years, employing housing organizations to send testers out to view for-sale and rental properties as a means of determining whether landlords, lenders, agents, and others in the real estate community treat protected classes differently.

Cliff Long, CEO of the Birmingham Association of REALTORS® in Alabama, says discrimination in the rental process is the biggest issue in his market. When he was relocating to Birmingham three years ago, he experienced it firsthand. Long, who is African-American, says several landlords wanted him to produce financial records before they would show him rental units—a practice that fair housing groups say is often aimed at minorities only. Having just taken the top job at the association, Long decided not to file a complaint.

Nearly all respondents said if they encountered potential discriminatory language or actions, they’d likely address it the way Butler did—by engaging in some straight talk about the law with their client. Less than 3 percent of respondents to the survey said they’d file a complaint, and less than 1 percent said they’ve ever filed a fair housing complaint.

Do you discuss fair housing with buyers and sellers?

64% do.

Do you or your client bring up fair housing?

71% me. 26% both. 3% client.

Do you discuss fair housing in your office meetings?

64% do.

Source: REALTOR® Magazine survey of 2,300 NAR members

Putting Your Training to Work

As a member of the National Association of REALTORS®, you’ve made a commitment to equal treatment—not just because it’s the law but as part of the REALTORS® Code of Ethics. NAR requires that members stay up to date on the Code, completing training at least every four years. In addition, states and localities often have their own fair housing laws, so state and local associations administer specific fair housing training for their members. Typically, licensees are required to take a two- or three-hour course every two to four years.

So there’s little doubt that when clients ask questions about quality of schools, local demographics, and neighborhood safety, you know to refer them to reliable information sources for answers rather than give your opinion. Resist the temptation to skirt the subject, says Mabel Guzman, CIPS, a sales associate at properties in Chicago. You’re not teaching them anything by being coy. Be frank about why you can’t answer certain questions. Seize the opportunity to explain fair housing laws and why it would be illegal to offer your opinion.

Curiously, more than 30 percent of respondents to REALTOR® Magazine’s survey said they don’t talk about fair housing issues with buyers and sellers. Whether that’s because they don’t encounter discriminatory behavior or because they’re too uncomfortable to challenge that behavior is not clear. It can be tempting to overlook questions or statements from clients in order to avoid an awkward exchange that could affect your business relationship. Addressing such issues in a nonconfrontational way, with fair housing law as the framework, can help.

The Challenges Ahead

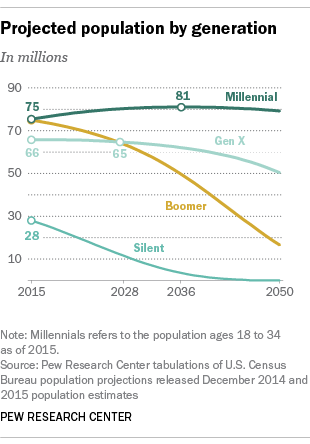

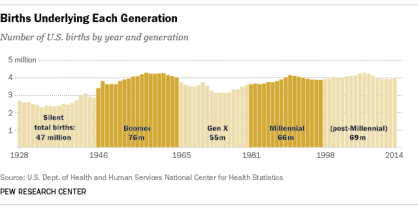

When you’re working with first-time buyers, particularly from new immigrant populations, you may need to actively educate your clients about fair housing law. Immigrants are an increasing target for discrimination in real estate, contends Lisa Rice, NFHA executive vice president, and many are unfamiliar with their rights under the law. “If no one is mean or disrespectful,” she says, “it’s not the first thing on your mind that maybe that house wasn’t made available to you because you were being discriminated against. Trained real estate practitioners can recognize discrimination and be part of how we bring awareness to the public.” The Alliance expects to see a rise in national origin–related cases in the coming years, Rice says.

As a Muslim woman living in the south, Firdaus Rahman, CRS, GRI, a sales associate at RE/MAX Partners in Mobile, Ala., admits she’s worried that Islamophobia—a hot-button issue in the 2016 presidential race—is becoming more acceptable and leads to unfair treatment. Rahman has been teaching fair housing and diversity courses through the Alabama Real Estate Commission since 2002, but the curriculum doesn’t go deeply into religion. She says the training needs an overhaul to reflect new issues surfacing in the field.

“You have to understand where people from different cultures are coming from,” Rahman says, adding that sensitivity to certain holidays and holy days is an important part of working with clients.

Also, because some cultures don’t participate in banking and savings in ways that are customary in the U.S., landlords, lenders, and real estate practitioners may have to educate their clients about U.S. customs or even adjust their expectations. “When immigration reform begins, we’re going to need a lot of education,” Long says. “You can bet fair housing is going to be front and center, and we’re going to be in a bad position if we’re not ready to tackle this issue. I’d like to play a proactive role rather than a reactive role.”

Brokers can take the lead on that front and establish relationships with local fair housing organizations to get a better look at the issues facing local markets. After the NFHA filed discrimination lawsuits against several brokerages nationwide in 2007, including one in the Detroit area, Michigan REALTORS® partnered with fair housing groups around the state to bring regulators and practitioners together. The association developed a program to allow brokers to be voluntarily tested by fair housing groups for informational purposes, hoping it would foster more collaboration on training in the industry. “Part of the testing was about demystifying our relationship with fair housing centers,” says Brian Westrin, the association’s director of legal affairs. “There was a lot of unknown there about whether brokers could reach out and bring fair housing centers into their office for education.”

Addressing the Affordability Barrier

One of the underlying goals of fair housing law has been ending segregated housing patterns in the United States, but census data show the law has fallen short. So last year, President Barack Obama announced a new rule requiring local governments that receive federal housing funds to report how they use those funds to foster more integrated communities.

Has a transaction of yours ever failed to close because of a fair housing issue?

11% say yes.

Respondents who answered yes often cited their refusal to work with someone they perceived to be discriminatory.

Source: REALTOR® Magazine survey of 2,300 NAR members

Lack of affordable housing can perpetuate segregation when it prevents protected classes from moving up the housing ladder. It’s a problem facing cities across the country, but none more acutely than San Francisco, where the median price was $940,000 in the fourth quarter of 2015. That’s why REALTORS® there have banded together to come up with solutions to the growing affordability crisis.

The real estate industry in San Francisco relies heavily on all-cash buyers—many from Asia—which pushes up prices and leaves other groups at a disadvantage, says Eugene Pak, president of the San Francisco Association of REALTORS® and sales manager at Climb Real Estate. One of SFAR’s primary goals this year is to work with local officials on a program to fasttrack the permitting process for residential developments that will deliver a certain percentage of affordable units. It currently takes eight to 15 years to build a large development because of the intense permitting process, Pak says. “We don’t only care about the needs of our millionaire clients,” he adds. “We believe in housing for all.”

Countering a Charge

If you’ve ever been on the receiving end of a fair housing complaint, you know how badly it can rock your world. Whatever the circumstances, you’ll have a better outcome if you take a serious, straightforward approach. Start by contacting your attorney. Then, call your local or state association’s legal hotline for advice on next steps. You’ll want to gather records of all contacts you’ve had with the complainant. That’ll be easier to do if you have a system for keeping track of all your client interactions, including e-mails, text messages, and signed agreements and contracts.

Once an investigation starts, it’s important to stay out of the way and let the investigators find out what happened, says Idaho practitioner Steve Osburn, who faced a complaint against his former company.

In 2008, a local fair housing group charged that one of his agents tried to steer sales in a new housing community toward people 55 and over. The Intermountain Fair Housing Council in Boise was performing testing in the community, which the developer had been advertising as an active-adult community, though it did not qualify for the Housing for Older Persons Act exemption to the Fair Housing Act. Osburn—at the time broker-owner of Windermere Real Estate/Capital Group Inc. in Boise—says the complaint was slim on details, and he was confident the agent had done nothing wrong. He fully cooperated with the U.S. Department of Housing and Urban Development’s investigation. “You don’t want to push too hard against the complaint or the investigation,” he says. “You don’t want to look like you have something to hide.”

The council dropped its claim with HUD but, nevertheless, filed a $300,000 lawsuit against Osburn’s company. During the discovery phase, Osburn’s attorney showed that HUD hadn’t found evidence of wrongdoing by the agent. The attorney said HUD was about to side with Osburn when the council dropped its claim. Osburn settled the lawsuit for $500 and admitted no wrongdoing.

“From a broker’s perspective, educate your agents frequently and talk about fair housing openly so they have good information,” says Osburn, now a broker-associate with Better Homes and Gardens 43° North in Meridian, Idaho. “Second, never roll over and just accept a complaint—but do allow the investigation to get the facts.”

Staying Within the Law

Some behaviors might not strike consumers or real estate professionals as clear-cut violations of the federal Fair Housing Act, which prohibits housing discrimination based on race, color, national origin, religion, sex, disability, and familial status. But HUD’s discrimination studies have found these common—yet often overlooked—infractions that you should be attuned to. Here are ways to avoid overstepping the law:

•If you ask clients to obtain a prequalification letter from a lender before showing them homes, apply that standard to everyone. Even if clients promise they have the ability to purchase, don’t give them a pass, or a case could be made that you offer differing levels of service. Whatever processes you use for one client, use for all.

•Don’t write listing copy that makes a judgment about the type of buyer who would be most interested in the home. For example, saying a home is “perfect for joggers” could be seen as excluding people with certain disabilities. Describe the property as being located “next to a jogging trail” rather than the person it would appeal to.

•Let the clients bring up whether they want to live near certain amenities, such as houses of worship, cultural institutions, or playgrounds. Making the suggestion yourself could be considered “steering” clients toward certain neighborhoods—a definite violation.

The country has come a long way over the past half-century when racial steering and disparate lending practices were common. And REALTORS® are on the forefront. But in an increasingly diverse country—where taking the first step toward buying or even renting can be a daunting task—you have an opportunity to do more: Teach your neighbors about what fairness in the real estate transaction looks like and empower those who’ve faced prejudice to challenge unequal treatment. Are you making the most of your platform?